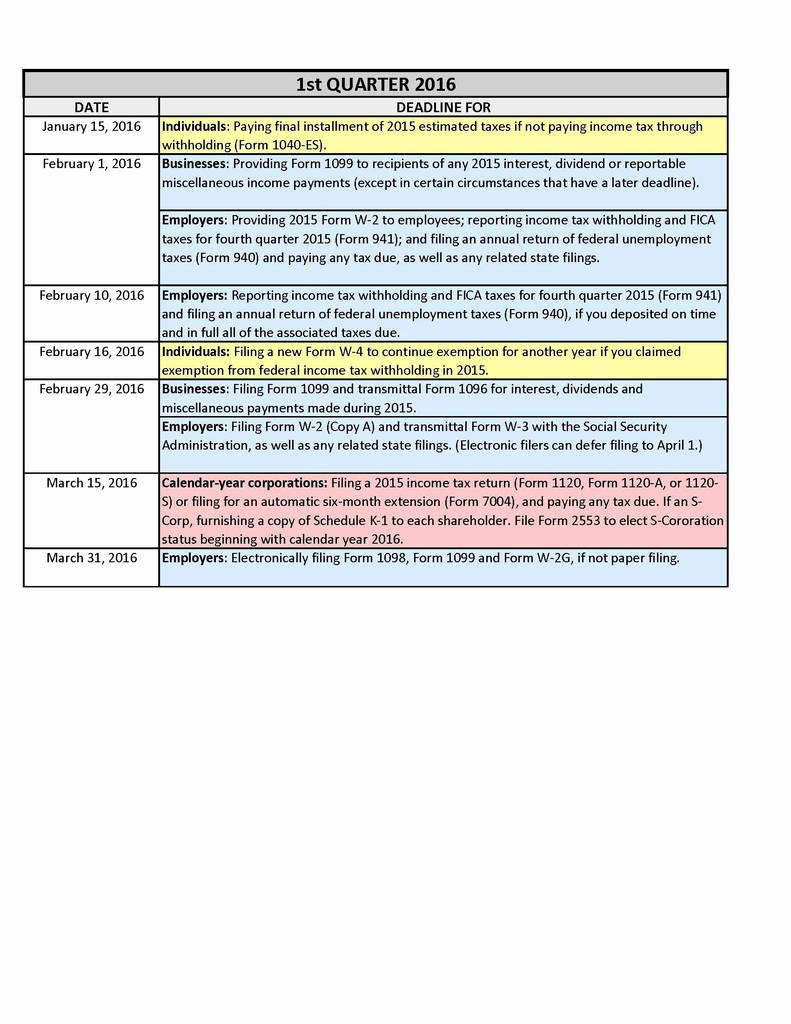

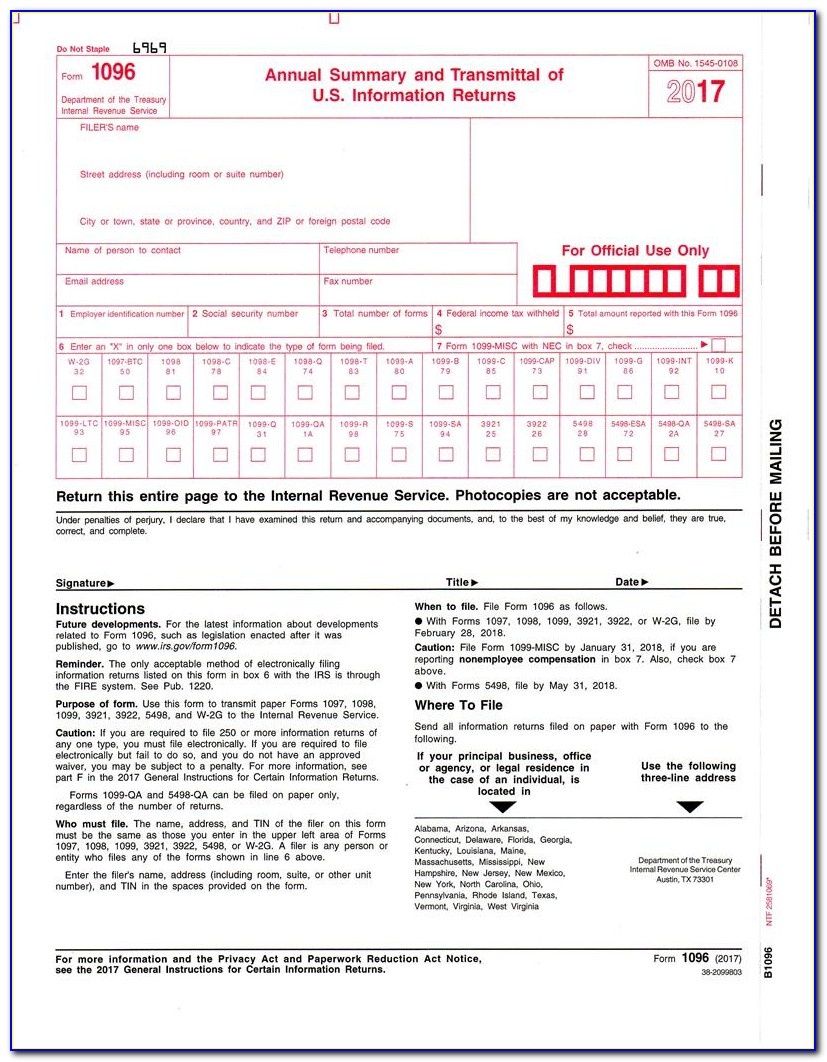

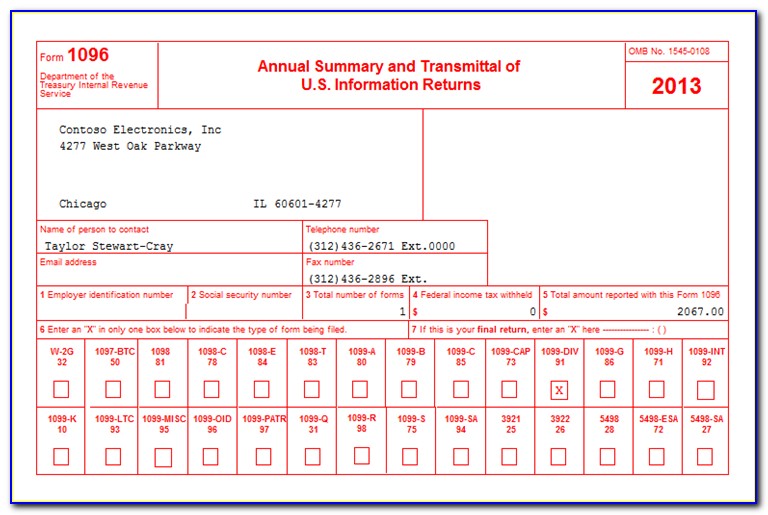

taxpayers, particularly professionals who paid more than $600 non-employee compensation to independent contractors in a financial year and used Form 1099, should fill out and submit Form 1096 when submitting paper reports to the IRS. According to the IRS, if you have 250 or more of any type of information return, you must file electronically. You should only use the form if you are physically filing the accompanying forms otherwise, if you are filing forms electronically, you do not have to use Form 1069. Information Returns, is a one-page transmittal form that serves as a cover sheet, reporting the summary of returns you are mailing to the Internal Service Revenue (IRS). Form 1040: 2021 U.S.Form 1096, or Annual Summary and Transmittal of U.S.You may file Forms W-2 and W-3 electronically (IRS).ATS Test Scenario 1 Taxpayer: Morgan Gardner SSN: (IRS).Form W-4V and give it to the payer, (IRS).Form 8832: Entity Classification Election (IRS).Requisito de Documentos de Apoyo Para Demostrar el (IRS).Form 8962: Premium Tax Credit (PTC) (IRS).Form 05: 20 Schedule AItemized Deductions 5 (IRS).Copy A of this form is provided for (IRS).

Once completed you can sign your fillable form or send for signing. Use Fill to complete blank online IRS pdf forms for free.

Fill Online, Printable, Fillable, Blank F1Form 1096 (IRS) Form

0 kommentar(er)

0 kommentar(er)